GST Accounting Software

Description :-

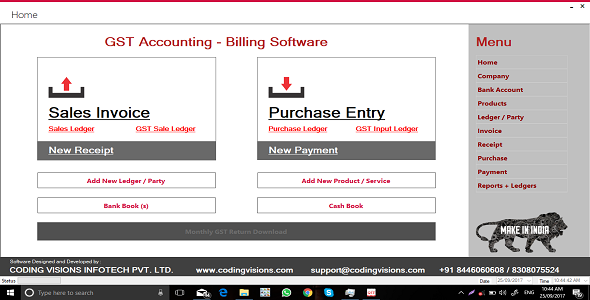

This GST Accounting System build using VB.Net in Visual Studio 2012.

This system is capable of managing all the gst billing along with filling the gst return.

{inAds}

Some of the module are Account Ledger, Sale Ledger, Purchase Ledger, Reports, GST Return, Database backup and restore,

Sale Billing, and many more to explore.

Check Software demonstration video on Youtube :

Check software Trial at

Prerequisites :-

.NET Framework 4.5

SAP Crystal Report Runtime 2015.

SQL Server 2008

Key Features:-

1. Company:

Add Company

Edit Company

2. Bank Account:

Add Bank Account

Edit Bank Account

3. Product:

Add Product

Search Product

Edit Product

4. Ledger/Party:

Add Party

Search Party

Edit Party

5. Invoice:

Add New Invoice

Search Invoice

Edit Invoice

6. Receipt:

Add Receipt

Search Receipt

Edit Receipt

7. Purchase:

Add New Purchase

Search Purchase

Edit Purchase

8. Payment:

Add Payment

Search Payment

Edit Payment

9. Reports:

Cash Book

Bank Book

Day Book

Account Ledger

GST Ledger

Income Ledger

Expense Ledger

Purchase Ledger

Sale Ledger

Product Ledger

Outstanding Report

Payable Report

Balance Sheet

10. Contra:

Bank To Cash

Cash To Bank

11. Database:

Backup Database

Restore Database

12. Settings:

Login

Add Users

Manage User

Software develop by: Coding Visions Infotech Pvt. Ltd.

Contact:

Change log and Updates

Version : 2.0

Released Date : 26 March 2019

#Change Log

1) Balance Sheet.

2) Advance Software Activation Integrated

3) Bar code Support Added.

4) Excel Export option added.

5) Some major bug fixes.

Version : 1

Released Date : 13 Dec 2017

#Initial Release

| Compatible Browsers | |

| Software Version | .NET 4.6 |

| Demo URL | |

| High Resolution | Yes |

| Files Included | Visual Basic VB, SQL, XML |

| Video Preview Resolution |